Monday, July 22, 2024

Air Vanuatu – What Are We Missing?

Sunday, July 21, 2024

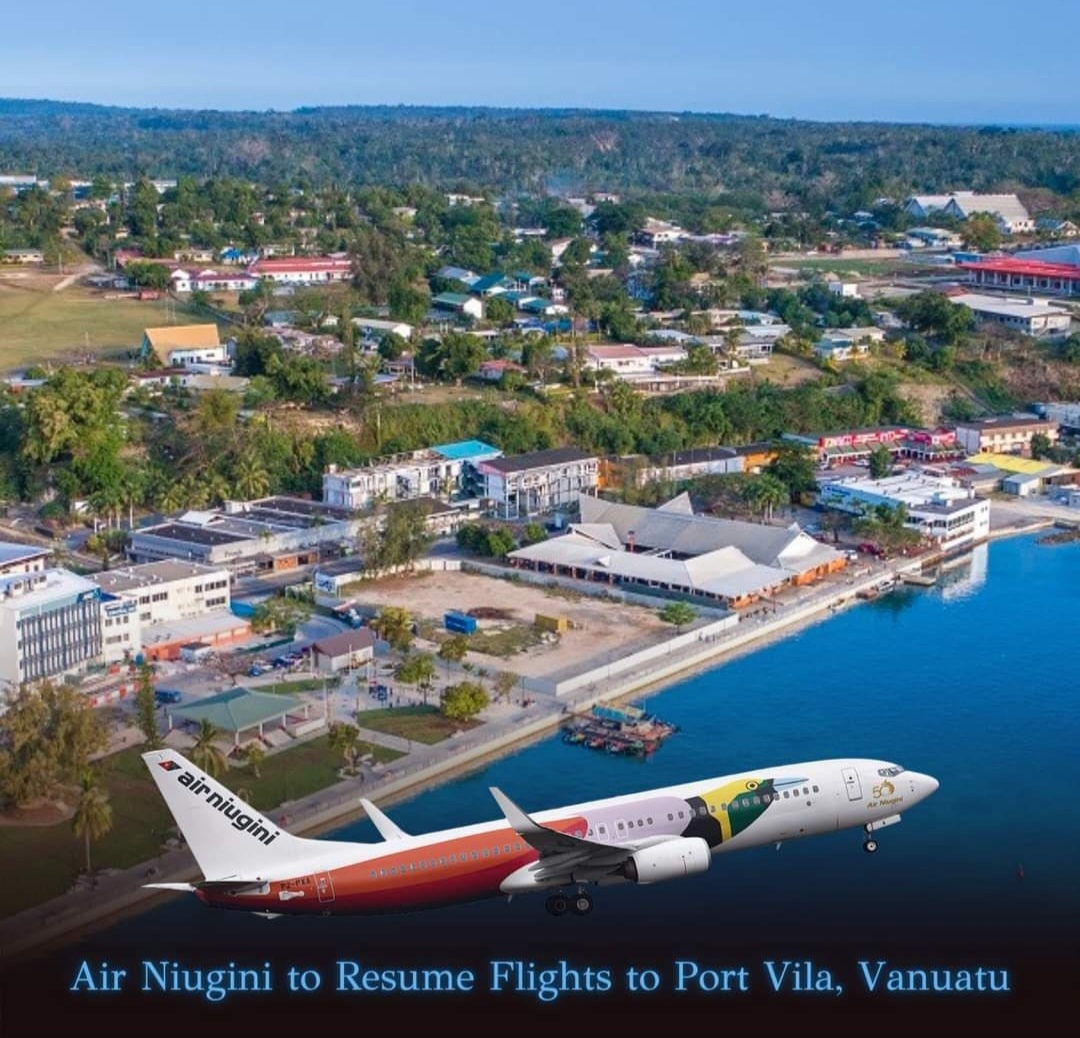

Air Niugini to Resume Flights to Port Vila, Vanuatu

Monday, June 10, 2024

Vanuatu Gov't Pays Redundancy for 177 Air Vanuatu Workers: VT219 million

The Vanuatu government has taken decisive action to pay the redundancy fees for 177 workers Air Vanuatu staff who were abruptly laid off on the 31st of May 2024, the sum of over VT219 million.

The 177 workers were supposed to receive their payment on the same day they were laid off, but due to banking processes, the payment did not go through that day. A government official updated that the payments would go through to the workers’ individual accounts yesterday afternoon.

It was stated by a Government official that the Government made this obligation since they are the staffs of Air Vanuatu, they are the citizen of Air Vanuatu, they are the people of Vanuatu.

“We want to look after them, it has to be clear to the citizens of Vanuatu that the Government had a great concern and care, they want that everything was right, but the problem is Air Vanuatu was bleeding over VT100 million a month.

“The payments will go through the bank accounts of the laid-off workers individually as of yesterday afternoon. The payment was made on Friday, the 31st of May 2024, but due to the banking process, there have been some delays,” the Government official stated.

After dismissing 177 staff members, Air Vanuatu (Liquidator) is now left with 266 staff members who will be undertaking critical tasks at the airport, such, while awaiting the final decision of the company’s future by the Liquidator, Ernst and Young.

On May 31, the Minister of Finance, John Salong, revealed that once a company acquires Air Vanuatu, it will no longer operate under the name Air Vanuatu Operations Limited. Possible new names include Air Vanuatu II or Air Vanuatu Unity.

He also stated that the Minister of Foreign Affairs and the Deputy Prime Minister, mandated by the Prime Minister, are heading a task force with other ministers to examine the future of the airline.

They will determine its name and the extent of Vanuatu’s shares, likely around 49% to 43%.

doddy@dailypost.vu

Thursday, May 30, 2024

Air Vanuatu is dead, long live Air Vanuatu!

The news of our national airline entering liquidation may have come as a shock to some people, but it was only a matter of time before it succumbed to the unrelenting abuse to which our political class has subjected it for decades. It was the same story that happens anywhere in the world when governments start managing airlines—it almost always ends badly.

On the face of its balance sheet, the company was doomed, with more than Vatu (VT) 7 billion in debt and more than VT100 million of recurring monthly excess costs. Service quality had long been abysmal, with many flights postponed or cancelled. Its board had become a carrousel of mismanagement, with a grand total of 56 directors since 2015 (see for yourself in the VFSC register). Add to this the COVID closures, severe bouts of bad weather, issues with the airport and runway, and sheer bad luck, and you get the perfect picture of an airline running on fumes. Air Vanuatu has been losing money for a long time; in fact most of the past 20 years have been in the red.

The final nail in the coffin was put in by the Court of Appeal (CoA) in February when it ordered Air Vanuatu to pay leasing company Isleno hundreds of millions of Vatu in damages and legal costs, ending 15 years of judicial saga.

The case was about the validity of a lease contracted in 2009, that was later deemed outrageously expensive and rejected by the succeeding Chief Executive Officer (CEO) after he learned that Isleno belonged to none other than the wife of his predecessor. After lengthy proceedings marred by significant political interference, the CoA finally sided with Isleno. To make a long story short, Air Vanuatu ended up with a bill 10 times higher than the purchasing price for an aircraft that it didn’t own – and didn’t even use!

Whatever one thinks of the court’s judgment, let’s all remember that Isleno was the symptom, not the problem.

The problem was that every single Prime Minister, Minister of Infrastructure, Minister of Finance, Minister of Trade, and every member of Parliament with the slightest connection to Air Vanuatu had been using it to trade in influence and financial gains for many years, maybe ever since its inception in 1981.

Isleno is one of the the latest (and arguably the biggest) of a long series of cases of gross mismanagement that plagued the airline as the consequence of years of rampant corruption and nepotism at its helm. If it wasn’t for this drama, a similar one was bound to happen.

A cautionary tale

The lesson to learn here is that Air Vanuatu was doomed by the simple fact that the government was its majority shareholder. Politicians here and everywhere are mere mortals, susceptible to greed and envy. In the absence of clear restrictions to their interference, state-owned enterprises are always vulnerable to abuse.

Successive administrations have used our national airline as a political tool for survival, offering positions and contracts in exchange for prolonged power and the achievement of their political goals. Regardless of whether these goals were well-intentioned or beneficial to the community, the fact remains that Air Vanuatu has emerged increasingly battered from this process.

Perhaps we, citizens of Vanuatu, are all responsible for this mess as we didn’t demand more accountability from our leaders. Had it been a private company, such levels of debt and deficit would have been unimaginable. But since no one seriously attempted to clean it up, it just kept on hemorrhaging cash with strikingly bad decisions, all the while lowering service quality for passengers.

Air Vanuatu’s CEO Joseph Laloyer and his management team have done their best under the circumstances to keep the business operational following the instructions of their shareholder. They have not compromised on safety and have kept us all secure, but the reliability of the airline has been diminishing year after year, despite rising costs.

No Airbus for us

One particularly painful expense was the deposit of VT2 billion made to Airbus in 2019 for no less than four A220 aircraft, with minimal external consultation. It was a bold move that could have worked, seen at that time as the way to save the airline. The new CEO and CFO in charge had a bold plan and a sound budget to achieve profitability, and the board at the time believed in their vision.

The next government proceeded to cancel the order, again with minimal consultation; it was politically justifiable since we had been hit by Covid and now the acquisition of these four jets appeared as an unjustifiable luxury.

The contract with Airbus was one-sided; if Air Vanuatu pulled out, it lost the 2 billion deposit, and Airbus could potentially sue Air Vanuatu for cancellation of commitment.

The good news is that anyone suing Air Vanuatu will get nothing as there is nothing left to steal, nothing left to abuse, nothing left to scavenge.

If Air Vanuatu had been privately owned, there’s a good chance it would have sought to recoup costs by reselling the contract to another operator. There’s huge demand worldwide for the A220 and Airbus probably resold “our” aircraft long ago anyway. But at the unsupervised, unaccountable, government-owned Air Vanuatu, the VT2 billion loss barely deserved a shrug, and apparently no one lost their job over it.

Airbus didn’t lose much in that deal, except for the cost of a few coats of paint on the first A220 in the contract. They ended up 99% in profit while we were thoroughly screwed.

Perhaps the liquidation of Air Vanuatu is a blessing in disguise, as it leaves ample room for entrepreneurs to pick up the slack and limits our government’s exposure to further risks of commercial exploitation by companies like Airbus.

What’s next?

A local company would certainly be preferable for the domestic routes. The government or a public institution like the Vanuatu National Provident Fund (VNPF) could be involved, but as a minority shareholder, and more importantly a silent one, sitting in the back and not trying to interfere in operations in any way, shape or form.

For international liaisons, we should open air service agreements to make it attractive for Fiji Airways and Aircalin to increase traffic to Vanuatu, and for Qantas and Air New Zealand to connect with major cities in their home countries Australia and New Zealand. This would keep Vanuatu well-connected with its Melanesian sister nations (Fiji/Kanaky) as well as these foreign powers who self-describe as development partners (France, New Zealand, Australia).

After all, Australia and New Zealand use a significant portion of our workforce to patch the holes in their labour market for the benefit of their economy; the least they can do is support air connectivity to Vanuatu. The flights would be mostly used by Ni-Vanuatu seasonal workers and students and by their own citizens coming to enjoy our beautiful sights as tourists.

If our development partners fail to convince their commercial airlines to step in, we might have to settle for a deal with Air Nauru or Air Solomon, but this should be the solution of last resort as these airlines have proven themselves highly unreliable in recent months. Let’s just say they have missed their opportunity to shine on many occasions.

One way to incentivize our Western development partners would be to formally request support from our other partner, China. This might seriously get their attention as they tend to prove more supportive when they feel that their influence is waning while China’s is rising.

The market economy is all about incentives. Where there’s demand, there’s supply, barring undue intervention from the state. The most profitable route with Vanuatu is obviously Sydney, but it’s not so clear that it would attract Qantas, as it is quite insignificant for an airline as big and reputable and would not matter much for their bottom line. If we take a good hard look at their incentives, we need them more than they need us. So we can cross our fingers and hope that our development partners in Canberra will push for this to happen.

A new chapter

It is now glaringly obvious to everyone that governmental management is not an adequate governance model for an airline. Our government should instead focus on public services and infrastructure, starting with Bauerfield Airport which is truly unworthy of the capital of a sovereign nation.

We should all recognise that Prime Minister Charlot Salwai and Finance Minister John Salong, along with the Council of Ministers, have proved remarkably clear-headed and responsible as they made the difficult but necessary decision to pull the plug on the wealth-destroying zombie that Air Vanuatu had become. They were the leaders who finally had the courage to stand up and call it a day. As the singer Kenny Rogers would put it, “You’ve got to know when to hold ‘em, know when to fold ‘em, Know when to walk away, and know when to run.”

Martin St-Hilaire is the Managing Director of AJC and also the Honorary Consul of Monaco in Vanuatu.

Thursday, May 16, 2024

Air Vanuatu Liquidators Update

Monday, May 13, 2024

AIR NIUGINI WELCOMES ANOTHER BOEING 737 AIRCRAFT

Friday, May 3, 2024

AIR NIUGINI’S BOEING 767 AIRCRAFT RESUME SINGAPORE AND BRISBANE FLIGHTS

Thursday, February 22, 2024

MEDIA RELEASE : AIR NIUGINI DECLARES PACIFIC GUARDIAN REPORT AS FAKE NEWS

Air Niugini is the national airline of Papua New Guinea, and recently celebrated 50 years of operation. The airline proudly serves the people with competent, accessible, reliable air transport services.